Please click on the link below for a SARS Media Statement regarding Covid-19:

New Directors Appointment

We are proud to announce the appointment of our Directors Jaco Nienaber, Kreshenke Smith and Leana Boonzaier.

We are blessed with a remarkable Leadership Team.

May your actions inspire others to dream more, learn more, do more and become more.

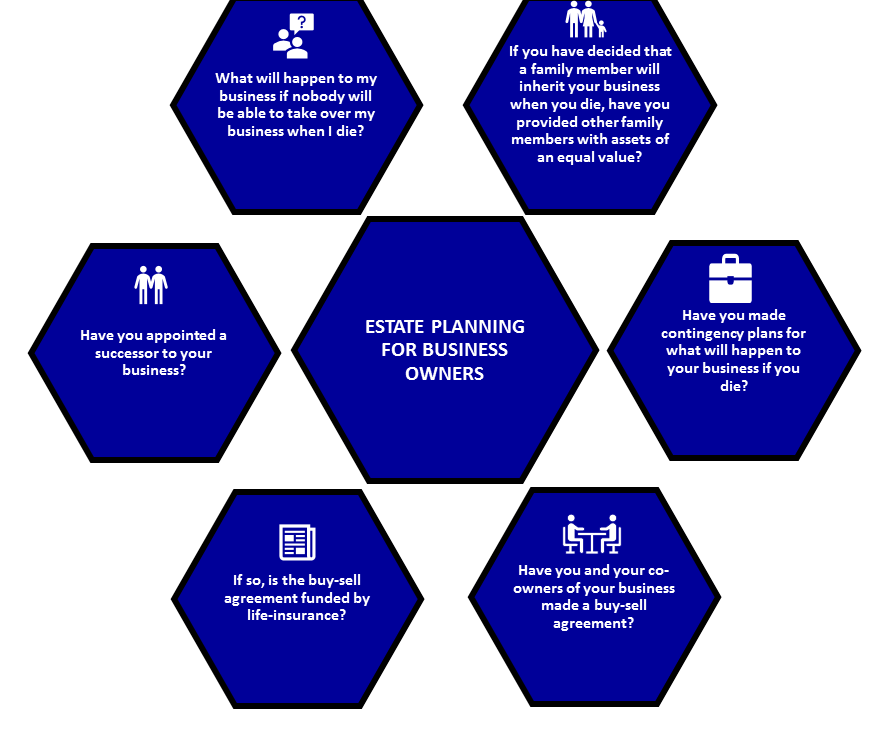

ESTATE PLANNING FOR BUSINESS OWNERS

SARS NOTIFICATION: TAX CLEARANCE CERTIFICATES

Dear Taxpayer

The issuing of the printed Tax Clearance Certificate (TCC) will be terminated after 25 October 2019, as we are fully implementing a more secure and electronic Tax Compliance Status (TCS) system.

Since the implementation of the TCS system in 2015, we advised taxpayers that our goal was to terminate the use of the printed TCC, and would stop issuing TCCs at a future date.

We have now reached a point where the ability to print a TCC will be terminated, and the TCS PIN will have to be used by taxpayers to share their tax compliance status electronically with third parties. In addition to terminating the ability to obtain and/or print a TCC, all active TCCs that are currently in circulation will be cancelled. You will therefore no longer be able to verify or print it.

You are encouraged to familiarise yourself with the electronic TCS system and the use of the TCS PIN, so as to be prepared when we entirely terminate the TCC concept.

The secure and convenient electronic TCS PIN provides you with a way to authorise any third party (an organisation or government department) to view your tax compliance status online via eFiling by providing them with the PIN. It will present them with your overall tax compliance status as at the date and time they view it, instead of your tax compliance status as it was at the date when the TCS PIN was issued to you. To protect the confidentiality of taxpayer information, no other information will be accessible to a third party through this process.

It is important to remember that your tax compliance status is not static, but changes according to your continued compliance with tax obligations.

For more information on how to use the TCS PIN, please refer to the “Guide to the Tax Compliance Status Functionality on eFiling”.

Sincerely,

THE SOUTH AFRICAN REVENUE SERVICE

August 2019

Please contact our office for further assistance.

SARS NOTIFICATION:

HOW TO REQUEST AN INCOME TAX NUMBER FOR A

NEW EMPLOYEE

Ref : SARS – 16/08/2019

It has come to our attention that job seekers are being asked for their Income Tax Reference Numbers in order to be considered for job interviews.

While we will readily assist persons who approach our offices to register, such processes are putting unnecessary strain on both the prospective employees and on our SARS branches.

It is important to note that SARS does not require a person to have a tax number when they are employed for the first time. We provide a variety of easy processes to register your employees for Income Tax, which do not require them to visit a SARS branch. The available processes to register your employees are:

- SARS e@syFile™ Employer (“Individual ITREG”) using Employee Registration; or

- Bundled registration (“Bundled ITREG”) available on e@syFile™ Employer allowing you to register up to 100 employees at a time but limited to 1 000 employees per month.

When registered as an organisation, employers can register individual employees on e Filing. When registered as a tax practitioner a file upload option is available in Excel or CSV file format on e Filing.

Sincerely,

THE SOUTH AFRICAN REVENUE SERVICE

August 2019

Please contact our office for further assistance.

WHEN TO REGISTER FOR VAT

1. Compulsory registration

- Total value of taxable supplies made in any 12 consecutive month period exceeds or is likely to exceed R1 million,

- A business is required to complete a VAT 101- Application for registration form and submit it to the local SARS branch within 21 days from the date of exceeding R1 million.

2. Voluntary registration

- A business may only choose to register for voluntarily for VAT if the total value of taxable supplies made or to be made is less than R1 million but exceeds R50 000 in the past period of 12 months.

3. Value of taxable supplies is less than R50 000

- A person carrying on an enterprise which has not made R50 000 in taxable supplies in the past 12 months, is also allowed to register for VAT, the person must be able to satisfy SARS that one or more of the following circumstance applies as a date of application of registration:

- Where a person has made taxable supplies for more than 2 months but less than 11 months, a person must prove that the value of taxable supplies in the preceding 12 months prior to the date of application for registration has exceeded R4 200 per month.

- Taxable supplies have been made for one month preceding the date of application for registration, a person must prove that the total value of taxable supplies exceeds R4 200 for the month.

- In the case of a person who has not made taxable supplies, a person must have a written contract, in terms of which the person is required to make taxable supplies exceeding R50 000 in the 12 months following the date of registration;

- In any other case, the person has entered into a finance agreement with a bank, specified credit provider, designated entity, public authority, non SA resident or any other person who continuously or regularly provides finance, wherein finance has been provided to fund the expenditure incurred or to be incurred in furtherance of the enterprise, and the total repayments in the 12 months following the date of registration will exceed R50 000

- In any other case, the person has proof of expenditure incurred or to be incurred in connection with the furtherance of the enterprise as set out in a written agreement or proof of capital goods acquired in connection with the commencement of the enterprise and proof of payment or extended payment agreement evidencing payment has either exceeded R50 000 at the date of application for registration or that will in any consecutive period of 12 months beginning before and ending after the date of application, exceed R50 000; or will in the 12 months following the date of application for registration exceed R50 000.

VAT Categories and the meaning of each category

|

Category A |

o A vendor is required to submit one return every two calendar months. o January, March, May, July, September and November o The commissioner will determine whether a vendor falls within this category. |

|

Category B

|

o A vendor is required to submit one return every two calendar months. o February, April, June, August, October and December. o The commissioner will determine whether a vendor falls within this category. |

|

Category C

|

o A vendor is required to submit one return for each calendar month. o January – December (12 months). o When will one fall within this category:

|

|

Category D

|

o A vendor submits one return every six calendar months. o February and August. o This category applies mainly to the following vendors:

|

|

Category E

|

o A vendor is required to submit one return for every twelve months, ending on the last day of the vendor’s year of assessment. o This category applies to a vendor that is a company or trust fund. |

IMPORTANT NOTICE – TAX SEASON 2019

SARS raises threshold for submissions, but it doesn’t exempt you from tax

The South African Revenue Service’s new head Edward Kieswetter has raised tax threshold for the submission of return from R350,000 to R500,000 – what does this mean in terms of how these individual taxpayers must relate to SARS? To discuss the latest changes, Nompu Siziba speaks with Ettiene Retief, the chairman of the national tax and Sars committee, SAIPA. They also discuss the factors that will exempt certain people from submitting tax returns, but Retief emphasises that individuals under the R350,000 threshold still has to pay tax.

PLEASE CLICK ON THE LINK BELOW TO LISTEN TO THE RADIO INTERVIEW:

https://iono.fm/e/696141

RECORD KEEPING:

How long do you need to keep documents?How to keep records?

PART 4 – Labour relations, Body Corporate & Home owners associations

|

LABOUR RELATIONS |

|

|

Written particulars of employee must be kept after termination of employment |

3 years after the termination of employment |

|

Employee name and occupation |

3 years from the date of the last entry in the record |

|

Time worked by each employee |

|

|

Remuneration paid to each employee |

|

|

Date of birth of any employee under 18 years of age |

|

|

Any other prescribed information |

|

|

Employer must keep records for each employee specifying the nature of any disciplinary transgressions, the actions taken by the employer and the reasons for the actions |

Indefinite |

|

|

|

|

SECTIONAL TITLE SCHEMES – Body Corporates / Home Owners Associations |

|

|

Must ensure that all books of account and financial records are retained |

Six years after completion of the transactions, acts or operations to which they relate |

RECORD KEEPING:

How long do you need to keep documents?How to keep records?

PART 3 – Health and Safety, Insolvency and Liquidation

|

HEALTH AND SAFETY |

|

|

Register or other record of the earning and other prescribed particulars of all the employees |

4 years after the date of the last entry in that register or record |

|

An employer shall keep at a workplace, a record of all incidents which he or she is required to report and also of any other incident which resulted in a person concerned having had to receive medical treatment other than first aid |

3 years |

|

|

|

|

INSOLVENCY AND LIQUIDATION |

|

|

Insolvent estates which have been finally liquidated or in course of liquidation and only with permission of the Master, the trustee may destroy all books and records in his possession relating to the estate |

6 months from the confirmation by the Master of the final trustees’ account |

|

Insolvent estates which have been finally liquidated, all record sin his office relating to the estate of that insolvent |

After 5 years have lapsed from the rehabilitation of an insolvent |

RECORD KEEPING:

How long do you need to keep documents?How to keep records?

PART 2 – COMPANIES

| Company records: Any documents, accounts, books, writing, records or other information that a company is required to keep in terms of the Act and other public regulations | 7 years or longer |

| Notice of Incorporation | Indefinite |

| Memorandum of Incorporation and any amendments made thereon | Indefinite |

| Rules | Indefinite |

| Register of company secretary and auditors | Indefinite |

| Notice and minutes of all shareholders meetings including, resolutions adopted and documents made available to holders of securities | 7 years |

| Copies of reports of annual general meetings of the company | 7 years |

| Copies of annual financial statements | 7 years |

| Copies of accounting records | 7 years |

| Record of directors and past directors, after the director has retired from the company | 7 years |

| Written communication to holders of securities | 7 years |

| Minutes and resolutions of directors’ meetings, audit committee and directors’ committees | 7 years |

| Securities register and uncertificated securities register (Shares) | Indefinite |

RECORD KEEPING:

How long do you need to keep documents?How to keep records?

PART 2 – CLOSE CORPORATIONS

| CLOSE CORPORATIONS | |

| Accounting records, including supporting schedules to accounting records and ancillary accounting records | 15 years |

| Amended Founding Statements (CK2 and CK2) | Indefinite |

| Annual financial statements, including annual accounts and the report of the accounting officer | 15 years |

| Founding statement (CK1) | Indefinite |

| Minutes books as well as resolution passed at meetings | Indefinite |

RECORD KEEPING:

How long do you need to keep documents?How to keep records?

PART 1: Individuals

Records must be kept

- in their original form;

- in the form, including electronic, prescribed by the Commissioner by public notice; or

- in the case of a request by a specific taxpayer to retain records or documents in a different but acceptable form, the form authorised by a senior SARS official;

- in an orderly fashion;

- in a safe place; and

- open for inspection, audit or investigation by SARS or other relevant body.

How long must records be kept?

| PERSON | PERIOD |

| A person who has submitted a return | Five years: counting from the date of submission of a return until the last day of the period |

| A person required to submit a return but has not complied | Five years: After the end of the five years period, indefinitely until the return is submitted |

| A person who is not required to submit a return, but has during a tax period, received income, has a capital gain or loss or engaged in any other activity that is subject to tax or would be subject to tax but for the application of a threshold or exemption | Five years or until the audit is concluded, whichever occurs first |

| A person who has lodged an objection or appeal against an assessment or decision under the Tax Administration Act | Five years or until the disputed assessment or decision becomes final, whichever occurs first |

| A person who has been notified or is aware that the records are subject to an audit or investigation | Until the audit or the investigation is concluded |

EXPECT MORE AUDITS FROM SARS!

The Resurrected Taxman Cometh – SARS large business centre to be re-established

by Melanie Le Roux | Mar 1, 2019

As the South African Government gears up to increase tax revenues, SARS is responding by intensifying its tax collection efforts. Taxpayers can expect more tax audits.

Acting SARS commissioner, Mark Kingon, said the revenue service was establishing various measures to ensure tax compliance. SARS’s large-business centre division, which provided specialist services and ensured compliance by large corporates and high-net-worth individuals, will be re-established by April 2019.

Finance Minister, Tito Mboweni, made it abundantly clear that not paying taxes will not be tolerated. At a media briefing on Wednesday ahead of his budget speech to Parliament he said, ‘So please do render unto Caesar what belongs to Caesar because Caesar can break your bones.’

Mboweni said he had commissioned Judge Dennis Davis to assess the tax gap — the difference between what SARS collects and what it expected to collect. ‘We need to understand why there is a gap between what we should be collecting and what we are collecting and then look at those serious areas which create a tax gap.’ He emphasised that SARS had to address tax morality by getting its auditing and investigative units back into shape. ‘It is actually saying you have got to pay your fair share and we will find you, and if we find you and you haven’t co-operated then there are criminal sanctions.’

At a time when the government is desperately in need of money, Mboweni announced that revenue collection for 2018-2019 is expected to be R15.4-billion less than that which was estimated in the medium-term budget policy statement in October. The projected shortfall of R27.8-billion has now been revised to R42.8-billion.

Extracts from: Mail & Guardian, 22 February 2019, by Tebogo Tshwane

SUMMARY : SECTION 12 J COMPANIES

Mission:

To encourage investment in South Africa.

Sectors:

Technology, agriculture, education, renewable energy, health care, private equity, pure venture capital and mining.

Fund Manager:

Must have fund manager with experience and expertise to drive investments.

Section 12J:

In terms of Income Tax Act to allow SA Tax payers to claim deductions on investments in Section 12 J Venture Capital Companies.

FSCA & FSP:

12J is approved by SARS and must be registered with FSCA (Financial Sector Conduct Authority) and must be licenced with FSP (Financial Service Provider).

Tax deduction:

a) Tax incentive in the form of reduction in investor’s taxable income equal to the 100% investment;

b) May be carried over as an assessed loss in case of company;

c) Individuals: The deduction subject to the investor having the taxable income to offset the deduction against;

Types of

1. Passive investment into 12J company:

Investment Number of Section 12 J Companies to receive tax deduction and return on their investment;

2. Forming a 12 J Company:

Assisting entrepreneurs with raising finance for their projects.

Requirements:

1. Investor cannot be a “Connected person” to the 12 J. in terms of Income Tax Act;

2. Minimum of 5 investors is required where no single investor holds more than 20 % equity in the 12 J company

3. An investor must be invested for 5 years and 1 day to avoid a recoupment

4. Must invest in Qualifying Companies;

Rule:

The Section 12 J has 3 years to make a minimum of 4 investments (80% / 20%) whereby no single investment can be more than 20%.

Impermissable

1. Any trade carried in respect of immovable property, other than a trades for investee trade carried on as a hotel keeper;companies 2. Any trade in the financial services sector;

3. Any trade in respect of financial or advisory services;

4.Any trade carried on in respect of gambling, liquor, tobacco, arms or ammunition.

Investee/qualifying

1. Investee company is a “controlled group company” and cannot company hold more than 69.9% equity in a qualifying company;

2.Section 12 J company must subscribed for issued equity shares in the qualifying company;

3.Investee company’s gross asset value <R50 million (R500 million for mining).

Penalties:

Sars will impose a penalty where:

1.an investor is a “Connected Person;

2.12J company fails to meet the requirements (80% rule);

3.Investors will be penalised between 125% to 225% on their tax deduction.

Exit:

1. Investor needs to invest for 5 years and 1 day to avoid recoupment on tax deduction;

2.On date that the investor disposes of its shares, the investor’s base cost for CGT is reduced to zero;

3.The terms of exit option is dependent on the type of investment made.

A few important facts about UIF:

- It is compulsory for Employers to register themselves and their Employee(s) as soon as they employ someone;

- Information of employees need to be provided to UIF every month for each employee for correct payment allocation at UIF for possible future claims;

- Employers must pay unemployment contributions of 2% of the value of each Employee’s salary/wage per month, the Employer and the Employee must each contribute 1% and the payment must be done before the 7th of each month to UIF or to SARS.

- If you and/or your employees are not registered for UIF or you are unsure if your payment is correctly allocated, please do not hesitate to contact us.

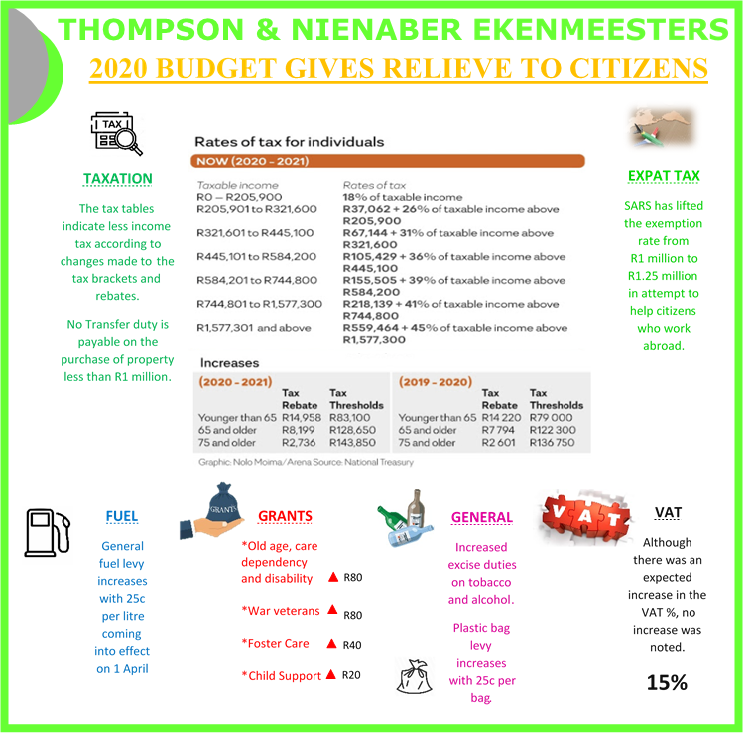

Get your tax affairs in order when you work abroad

Did you emigrate to another country? Or do you work for more than 183 days outside of South-Africa?

If the answer is YES, you must make sure that your tax affairs are in order.

It seems that there is a trend, where people who did not officially emigrate, believe that they don’t need to pay tax, as they are not planning to return to South Africa or because they work for more than 183 days outside of South Africa.

As from 1 March 2020, SARS will however still require from you to pay tax on your income earned above R1 million!

There is however a silver lining, you can “emigrate financially”!

“Financial emigration”? It sounds like a lot of paper work . . . It might be, but it has its advantages.

For more information about “Financial emigration” and the procedures thereof, please click on this link »

https://www.moneyweb.co.za/moneyweb-opinion/soapbox/earning-foreign-income-prepare-for-new-tax-now-or-get-hit-hard-later/